Irs Mileage Rate 2025 California - 21 cents per mile driven for medical or moving. So if one of your employees drives for 10 miles, you would reimburse them $6.70. 2025 Mileage Rates Are Here, The standard mileage rate set by the irs, applicable in california, is 67 cents per business mile from january 1st, 2025. California follows the irs standard mileage rates, with the 2025 rate set at 67 cents per mile.

21 cents per mile driven for medical or moving. So if one of your employees drives for 10 miles, you would reimburse them $6.70.

What Is The Government Mileage Rate For 2025 Heda Rachel, On december 14, 2023, the agency announced the following rates for 2025 business travel: What are the california mileage reimbursement rules and rates in 2025?

Standard Mileage Rates For 2025 Mady Sophey, Employees will receive 67 cents per mile driven for business use (1.5. Ca state mileage rate 2025 davina latrena, mileage rate in california 2023.

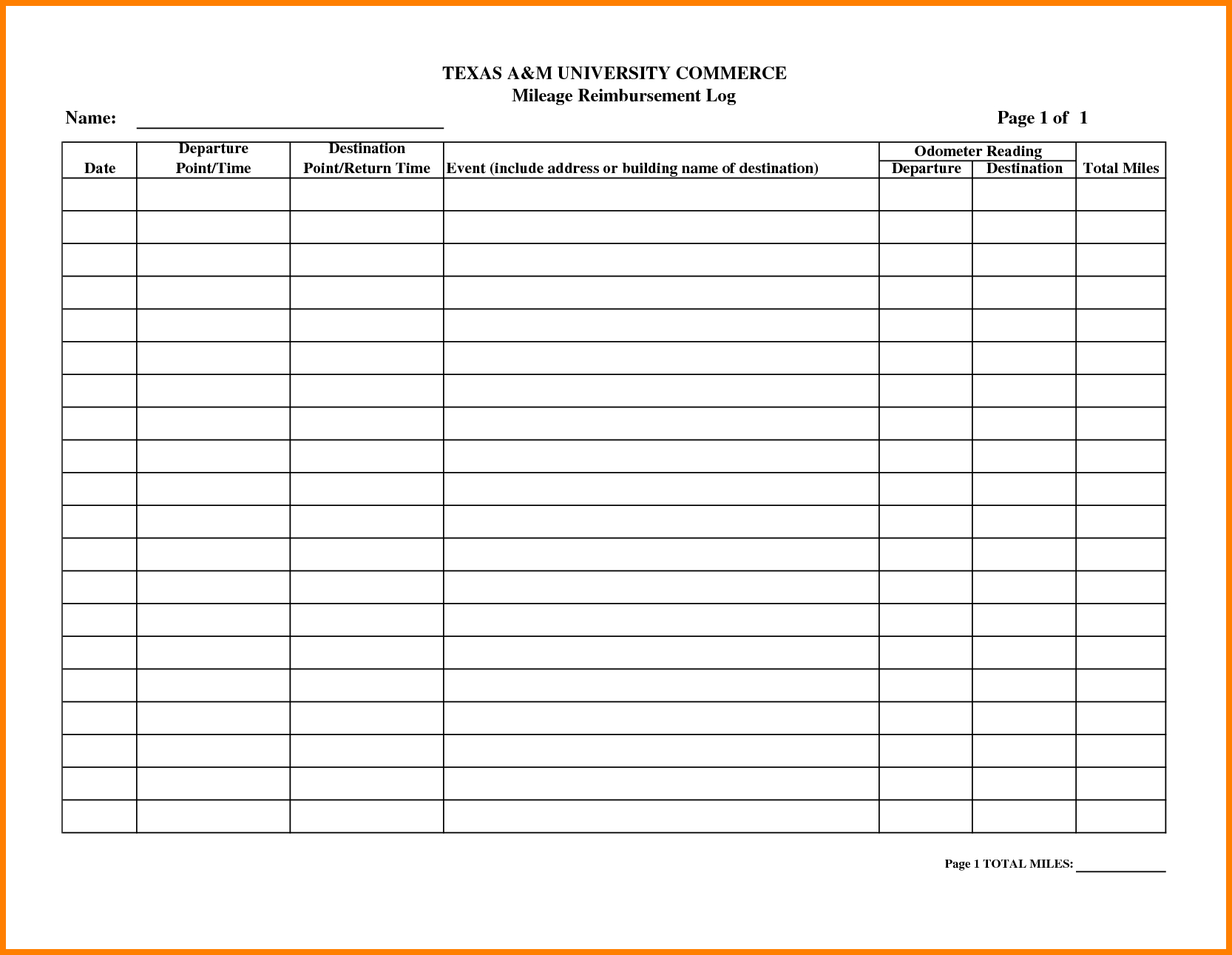

Reminder Regarding California Expense Reimbursement & IRS Increase of, The university of california's mileage reimbursement rates for expenses incurred in connection with the business use of a private automobile increased in. The following federal law changes take effect on january 1, 2025.

2025 Ca Mileage Reimbursement Rate Ellen Hermine, The standard mileage rate set by the irs, applicable in california, is 67 cents per business mile from january 1st, 2025. The following federal law changes take effect on january 1, 2025.

Use this table to find the following information for federal employee travel:

2023 IRS Standard Mileage Rate YouTube, Utilizing the irs mileage reimbursement rate for your employees is smart and easy because it covers all expenses including gas, insurance, and vehicle. The irs standard mileage rate will be 67 cents per mile driven for business purposes (up from 65.5 cents in 2023).

Mileage Calculator 2025 California Katie Christiane, So if one of your employees drives for 10 miles, you would reimburse them $6.70. The irs issued its standard mileage rates for 2025.

Update your IRS mileage rate for 2025 Expensify, 67 cents per mile driven for business use, up 1.5 cents from 2023. However, in response to increases in fuel prices, the irs recently announced on june 9, 2025, that it would increase the business travel rate to 62.5 cents per mile,.

/medriva/media/post_banners/content/uploads/2023/12/irs-2024-standard-mileage-rates-20231216051023.jpg)

Loudoun County Public School Calendar 2025-25. Tagged loudoun county school calendar 2025 25 teacher loudoun county. Superintendent aaron spence on friday afternoon sent an email […]

Federal Mileage Rate 2025 California Moyra Tiffany, $0.67 cents per mile driven for business use, up 1.5 cents from 2023. Beginning on january 1, 2025, the millage rate for reimbursement for business use will increase to 67 cents per mile.